Can You Claim Vat On Gifts For Employees . As an employer providing gifts to your employees, you have certain tax, national insurance and. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. sometimes a business might provide their employees with certain perks and rewards. These may take the form of either goods or. if you make gifts to one or more of your workers, you may need to account for vat. When does this apply and how is the vat.

from orientacionfamiliar.grupobolivar.com

sometimes a business might provide their employees with certain perks and rewards. As an employer providing gifts to your employees, you have certain tax, national insurance and. When does this apply and how is the vat. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. if you make gifts to one or more of your workers, you may need to account for vat. These may take the form of either goods or. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you.

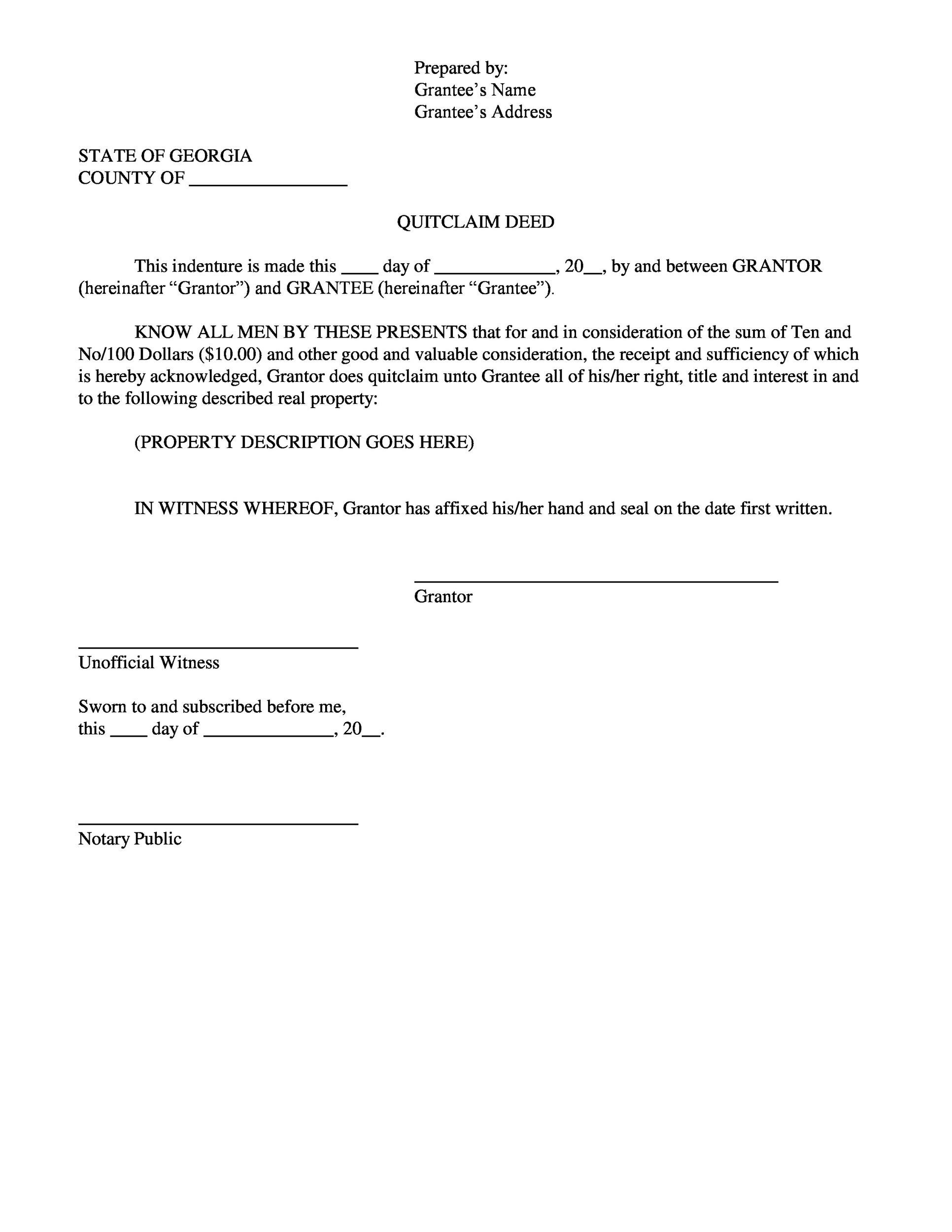

Free Printable Gift Deed Form Printable Word Searches

Can You Claim Vat On Gifts For Employees when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. These may take the form of either goods or. sometimes a business might provide their employees with certain perks and rewards. when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. As an employer providing gifts to your employees, you have certain tax, national insurance and. if you make gifts to one or more of your workers, you may need to account for vat. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. When does this apply and how is the vat.

From orientacionfamiliar.grupobolivar.com

Free Printable Gift Deed Form Printable Word Searches Can You Claim Vat On Gifts For Employees These may take the form of either goods or. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. if you make gifts to one or more of your workers, you may need to account for vat. As an employer providing gifts to your employees, you have certain tax,. Can You Claim Vat On Gifts For Employees.

From dxozdckwy.blob.core.windows.net

Can You Claim Land On Your Taxes at Gerald Gallagher blog Can You Claim Vat On Gifts For Employees As an employer providing gifts to your employees, you have certain tax, national insurance and. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. When does this apply and how is the vat. sometimes a business might provide their employees with certain perks and rewards.. Can You Claim Vat On Gifts For Employees.

From southafricanvatcalculator.co.za

Can You Claim VAT Back On Customer Gifts In South Africa? Can You Claim Vat On Gifts For Employees the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. if you make gifts to one or more of your workers, you may need to account for vat. As an employer providing gifts to your employees, you have certain tax, national insurance and. when it comes to vat,. Can You Claim Vat On Gifts For Employees.

From simpleinvoice17.net

28+ Uk Vat Invoice Template Free Images * Invoice Template Ideas Can You Claim Vat On Gifts For Employees As an employer providing gifts to your employees, you have certain tax, national insurance and. sometimes a business might provide their employees with certain perks and rewards. if you make gifts to one or more of your workers, you may need to account for vat. the threshold applies to individuals, not businesses, so you can spend up. Can You Claim Vat On Gifts For Employees.

From www.businessaccountingbasics.co.uk

Free Excel Business Expense Template Business Claim Forms Can You Claim Vat On Gifts For Employees These may take the form of either goods or. When does this apply and how is the vat. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. As an employer providing gifts to your employees, you have certain tax, national insurance and. sometimes a business. Can You Claim Vat On Gifts For Employees.

From authorizationletter.net

4+ Authorization Letter to Claim Templates With Example Can You Claim Vat On Gifts For Employees sometimes a business might provide their employees with certain perks and rewards. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. when it comes. Can You Claim Vat On Gifts For Employees.

From cefyzsnf.blob.core.windows.net

Can I Claim Vat On Staff Christmas Gifts at Joseph Rich blog Can You Claim Vat On Gifts For Employees When does this apply and how is the vat. These may take the form of either goods or. sometimes a business might provide their employees with certain perks and rewards. if you make gifts to one or more of your workers, you may need to account for vat. if an employee contributes to the cost of goods. Can You Claim Vat On Gifts For Employees.

From legaldbol.com

Invoice Template With Vat And Cis Deduction Cards Design Templates Can You Claim Vat On Gifts For Employees when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. if you make gifts to one or more of your workers, you may need to account for vat. the threshold applies to individuals, not businesses, so you can spend up to. Can You Claim Vat On Gifts For Employees.

From cefyzsnf.blob.core.windows.net

Can I Claim Vat On Staff Christmas Gifts at Joseph Rich blog Can You Claim Vat On Gifts For Employees When does this apply and how is the vat. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. These may take the form of either goods. Can You Claim Vat On Gifts For Employees.

From www.vrogue.co

Authorization Letter Sample For Sss Pension Authoriza vrogue.co Can You Claim Vat On Gifts For Employees if you make gifts to one or more of your workers, you may need to account for vat. These may take the form of either goods or. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. the threshold applies to individuals, not businesses, so. Can You Claim Vat On Gifts For Employees.

From www.youtube.com

SARS eFiling How to submit your ITR12 YouTube Can You Claim Vat On Gifts For Employees when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. As an employer providing gifts to your employees, you have certain tax, national insurance and. if an employee contributes to the cost of goods or services you must account for vat on. Can You Claim Vat On Gifts For Employees.

From legaldbol.com

Sample Vat Invoice Template Cards Design Templates Can You Claim Vat On Gifts For Employees These may take the form of either goods or. sometimes a business might provide their employees with certain perks and rewards. As an employer providing gifts to your employees, you have certain tax, national insurance and. When does this apply and how is the vat. if you make gifts to one or more of your workers, you may. Can You Claim Vat On Gifts For Employees.

From www.youtube.com

Do I Owe SARS Money..? YouTube Can You Claim Vat On Gifts For Employees As an employer providing gifts to your employees, you have certain tax, national insurance and. if an employee contributes to the cost of goods or services you must account for vat on the amount they pay you. when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for. Can You Claim Vat On Gifts For Employees.

From southafricanvatcalculator.co.za

Can You Claim VAT Back On Customer Gifts In South Africa? Can You Claim Vat On Gifts For Employees As an employer providing gifts to your employees, you have certain tax, national insurance and. if you make gifts to one or more of your workers, you may need to account for vat. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. if an employee contributes to. Can You Claim Vat On Gifts For Employees.

From help.gettimely.com

VAT and Gift Vouchers Timely Can You Claim Vat On Gifts For Employees if you make gifts to one or more of your workers, you may need to account for vat. When does this apply and how is the vat. As an employer providing gifts to your employees, you have certain tax, national insurance and. These may take the form of either goods or. when it comes to vat, you can. Can You Claim Vat On Gifts For Employees.

From www.jotform.com

Tax Deduction Letter Sign Templates Jotform Can You Claim Vat On Gifts For Employees These may take the form of either goods or. the threshold applies to individuals, not businesses, so you can spend up to £50 on employees working within the. As an employer providing gifts to your employees, you have certain tax, national insurance and. if an employee contributes to the cost of goods or services you must account for. Can You Claim Vat On Gifts For Employees.

From www.dochub.com

Vat65a notes Fill out & sign online DocHub Can You Claim Vat On Gifts For Employees when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. These may take the form of either goods or. if you make gifts to one or more of your workers, you may need to account for vat. When does this apply and. Can You Claim Vat On Gifts For Employees.

From pinkpigfinancials.co.uk

Tax and VAT implications on gifts Pink Pig Can You Claim Vat On Gifts For Employees As an employer providing gifts to your employees, you have certain tax, national insurance and. when it comes to vat, you can claim the input vat on gifts acquired for business purposes, which includes gifts for staff and customers (although not. sometimes a business might provide their employees with certain perks and rewards. the threshold applies to. Can You Claim Vat On Gifts For Employees.